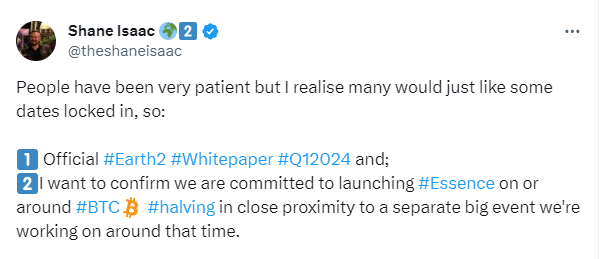

I am aware that everyone within the Earth2 Community is eagerly awaiting the announcement of the token launch date. Shane Isaac, the founder and CEO of Earth2, the coolest metaverse, has recently posted on X, formerly known as Twitter, and mentioned,

Bitcoin Halving is a predetermined event that occurs approximately every four years, reducing the rewards miners receive for validating transactions by half. .

Table of Contents

ToggleBackground

Firstly, the concept of Bitcoin should be envisioned as digital currency, presenting a sophisticated method for conducting online transactions devoid of conventional coins or bills. Bitcoin operates as a personal clandestine key for executing online transactions.

The initiation of Bitcoin halving did not originate from a designated individual or entity; instead, it constitutes an inherent aspect of the Bitcoin protocol introduced by its pseudonymous creator, Satoshi Nakamoto. The term “Satoshi Nakamoto” is employed to refer to the undisclosed person or group responsible for the creation of Bitcoin and the drafting of its original whitepaper, published in 2008.

What is Bitcoin halving?

Envisage a preferred video game wherein special coins are earned by overcoming challenges, serving as rewards, analogous to how Bitcoin miners are rewarded for contributing to the security of the Bitcoin network.

In this gaming scenario, the decision is made by the creators to periodically diminish the quantity of coins attainable every few levels. This functions as a rule established to prevent an inexhaustible supply of these distinctive coins, ensuring sustained interest and the preservation of the coins’ value.

Bitcoin halving bears resemblance to this gaming scenario. Within the realm of Bitcoin, a rule is ingrained in the system dictating that every four years, the remuneration provided to Bitcoin miners for their efforts is halved. This occurrence is denoted as “halving,” akin to the creators of the game deciding to curtail the attainable number of coins to maintain a controlled circulation.

To comprehend Bitcoin Halving, consider the use of a table. Visualize possessing a mystical piggy bank generating a predetermined number of coins daily. Nevertheless, every four years, an enchanting wand is waved, causing the piggy bank to produce only half as many coins. Let’s delve into the details:

Bitcoin Halving Table

| Year | Daily Coin Production |

|---|---|

| 2012 | 50 |

| 2016 | 25 |

| 2020 | 12.5 |

| 2024 (hypothetical) | 6.25 |

Why it is important?

Bitcoin Halving ensures there will only be 21 million Bitcoins. It’s like having a rare collection of trading cards; the rarer they are, the more valuable they become.. This is a big deal because it makes Bitcoin more scarce over time. Scarcity means there’s only a limited amount of something. And when something is scarce, people often think it’s more valuable. So, Bitcoin halving is one of the reasons why some people believe Bitcoin is special and might become more valuable in the future. Just remember, it’s like a built-in rule in the Bitcoin system to keep things interesting and to make sure that people continue to find value in using and holding Bitcoin.

Timeline

The first Bitcoin block, known as the “genesis block,” was mined by Nakamoto in January 2009. In the Bitcoin codebase, Nakamoto implemented a rule that automatically reduces the reward given to miners for adding new blocks to the blockchain. This reduction happens approximately every four years, or every 210,000 blocks. The process is colloquially referred to as “halving” because the reward is halved.

Bitcoin Halving Events

| Halving Event | Year |

|---|---|

| 1 | 2012 |

| 2 | 2016 |

| 3 | 2020 |

| 4 (hypothetical) | 2024 |

Who Will Be Impacted by Bitcoin Halving?

Now that we’ve unraveled the mystery of Bitcoin Halving, let’s explore who gets affected by this fascinating event. Understanding its impact can provide insights into the broader cryptocurrency world.

Miners:

The primary group affected by Bitcoin Halving is the miners. These are the computer wizards who secure and validate Bitcoin transactions. With each halving, their rewards get cut in half. Imagine being a miner in 2012, getting 50 Bitcoins for validating a block. In 2020, it’s reduced to 12.5, and in the next halving, it might further decrease to 6.25. This reduction affects their profits, making mining less lucrative over time.

Investors:

Bitcoin investors also feel the ripple effect. As the supply of new Bitcoins slows down, the existing ones become more valuable. It’s like having a share in a rare company – if the company becomes more exclusive, your shares become more valuable. So, investors who own Bitcoins might see an increase in the value of their holdings over the long term

Traders and Exchanges:

For those involved in trading and running cryptocurrency exchanges, Bitcoin Halving can bring increased market volatility. As the event approaches, traders may adjust their strategies, and the price might experience fluctuations. This dynamic environment can present both challenges and opportunities for those navigating the crypto markets.

Developers and Innovators:

Bitcoin Halving can also impact the broader cryptocurrency ecosystem. Developers and innovators in the blockchain space might be inspired to create new solutions as a response to the evolving dynamics. The scarcity introduced by Bitcoin Halving could drive innovation in the development of alternative cryptocurrencies or improvements to existing blockchain technologies.

FAQ

Bitcoin Halving Questions

Conclusion

In the grand scheme of things, Bitcoin Halving is like a ripple in a pond, affecting various players in the cryptocurrency arena. From miners to investors and beyond, each group experiences its own set of changes and challenges. Understanding these impacts provides us with valuable insights into the evolving world of digital currency. As we continue to explore the frontiers of technology, who knows what exciting developments lie ahead in the realm of cryptocurrency? Stay tuned, stay curious, and embrace the future of finance!